From underwriting to solvency ratios. Make better decisions, based on fact.

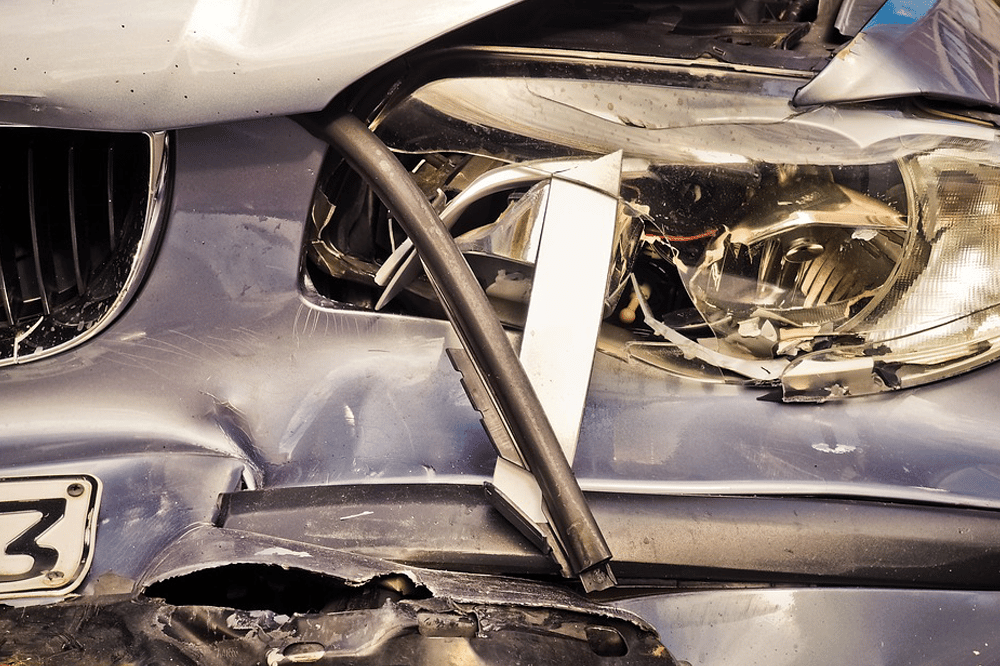

Some of our favourite customers include insurance companies. Our solutions helped them detect trends in insured events and identify suspicious activities. We are happy to introduce you to our powerful applications to help you increase the amount of premium.

Our solutions for insurance companies can help you set optimal insurance policies to increase the competitiveness of your insurance products. Are you sure you offer the right products to right customers at the right time?

Our solutions will help you get your business on the right track – where it is necessary. We also have a solution which lets you model insurance contracts and repayment calendars.

A few references from the insurance segment

Which processes in banking can we cover?

Executive management

Core insurance business

Sales

Digital marketing

Risk Management

Procurement

Finance

Human Resources

Quality Management

Project Management

Information Technology

Branch and Agent Management

Measure your success

Important insights into how bank and its components performs provide KPI metrics. We will help you to watch them. Monitor what’s contributing to your profit and what’s not. Strictly measured KPIs will provide you detailed and always handy overview on performance of your business, your branches, departments, employees, brokers, products, customer groups… See the direct link between particular elements of your business and revenue, so you can make flawless strategic decisions on everything you can think of.

What KPIs we can help you with?

- Average insurance policy size

- Number of claims

- Cost per Claim

- Customer Satisfaction

- Claims Ratio

- Earned Premiums

- Expenses

- Loss adjustment expenses (LAE)

- Claims Duration

- New policies

- Policy Sales Growth (%)

- Policy Size

- Net Income Ratio

- Revenue per Policy Holder

- New policies per agent

- % loss ratio

- Average claims processing time

- Under writing speed of insurances

- Claims forecast versus actual

- % policy renewal rate

- Interest Income

- Non-interest Income

- RoA (Return on Asset)

- Return on CAL

- Average asset per employee

- Cash dividends to net income

- Adjusted operation income

- Total interest income

- Other KPIs

How do we help Insurers?

Agency & Insurance Brokers

- Sales & Revenue Analysis

- Customer Targeting

- Broker /Agency Analysis

- Sales Performance Analysis

- Online Channel Performance

Executive Management

- Executive Dashboards and Mobile

- Balanced Scorecards

- Predictive / What-If Analysis

- Product Performance

- Performance, Margins, Commissions

Claims

- Integrating Underwriting & Claims

- Fraud Investigation

- Supplier Management

- Claims Processing

- Reserve Adequacy

Risk Management & Compliance

- Solvency II Compliance

- Actuarial Loss Triangles

- Risk & Exposure Analysis

- Credit, Market, Portfolio, Operational

- Cross-Product / Counterparty Risk…

Underwriting

- Integrating Underwriting & Claims

- Loss Ratio Analysis

- Policy Portfolio Analysis

- Optimize Approval Process

- Resource Allocation

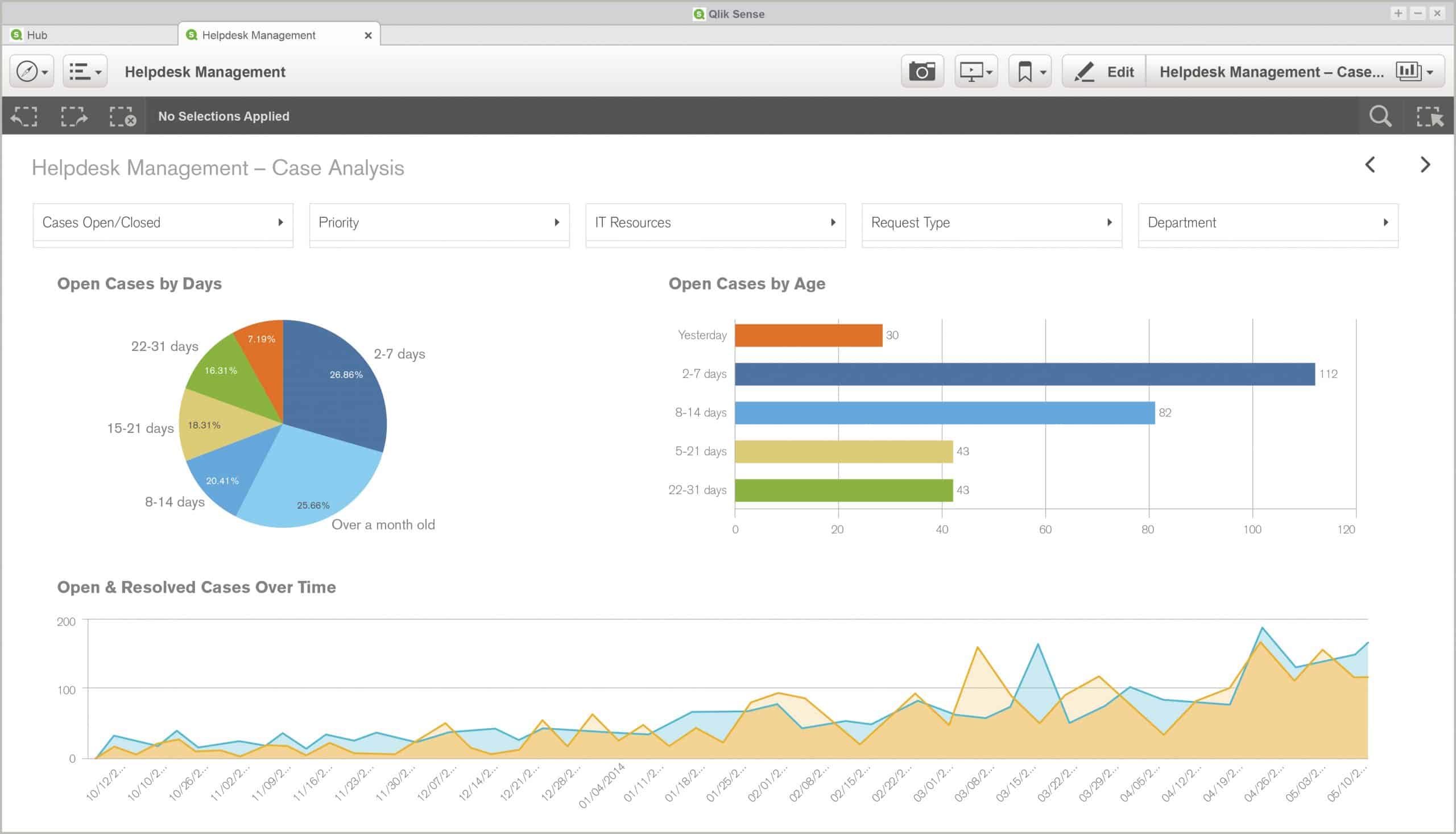

Operations, IT, & Back Office

- Expense Management

- Financial & Management Reporting

- P&L Analysis by LOB

- Fund Accounting / GL

- IT Systems & SLA Management

Investments

- Portfolio Management & Analysis

- Investment Performance / Profitability

- Investment Research

- Scenario / What-if Analysis

- AUM Analysis / NAV Interpolation

Marketing & Product Management

- Customer Retention

- Cross-sell and Up-sell

- Customer Profitability & Segmentation

- Product Performance Analysis

- Marketing Campaign Analysis

What else we can help you with?

Credit Risk Analytics – questions

- See and manage your credit portfolio

- Find out where your risks are concentrated

- Observe how your loan officers are performing

Customer analysis and targeting

- Understanding customer product concentration. Have you identified all cross/up sell opportunities? Do you know how to improve it?

- Customer analysis and targeting (Branch Performance Analytics)

- Helping with understanding the branches and targeting customers.

- Analyzes of the customer satisfaction

Asset/Investment Management

- Asset and investment analysis

Transaction monitoring

- Find opportunities to expand loan portfolio

- Enable regional managers to explore customers and loans that were maturing or callable, to up-sell additional products

- Automate processes that are completely manual